How Bank Code can Save You Time, Stress, and Money.

Wiki Article

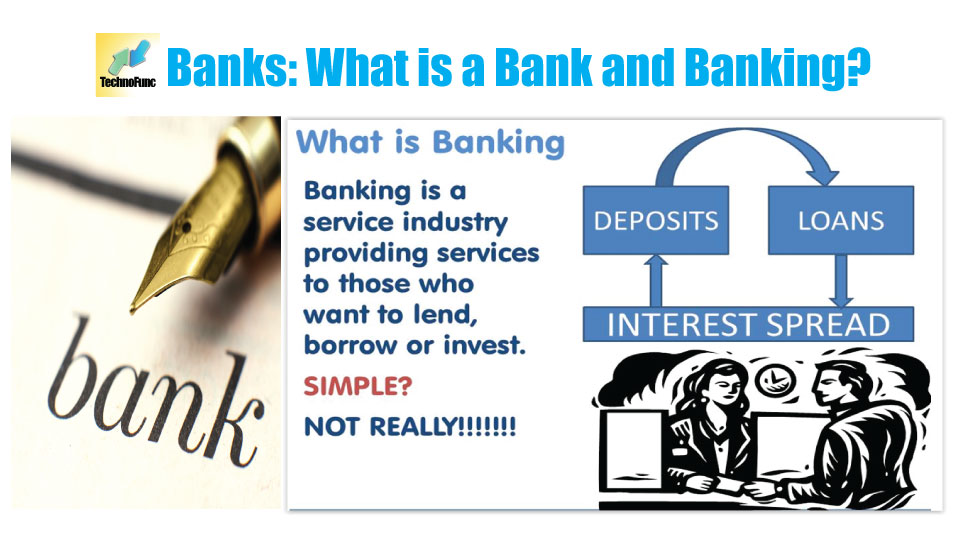

Banking Fundamentals Explained

Table of Contents4 Simple Techniques For Bank CertificateThe 30-Second Trick For Bank AccountAn Unbiased View of Bank Account NumberAn Unbiased View of Bank CodeThe Basic Principles Of Bank Statement

When a bank is perceivedrightly or wronglyto have issues, consumers, fearing that they might shed their deposits, may withdraw their funds so quick that the tiny portion of fluid assets a financial institution holds comes to be rapidly tired. Throughout such a "run on deposits" a bank may need to market other longer-term as well as much less fluid properties, commonly muddle-headed, to meet the withdrawal demands.

Regulatory authorities have wide powers to interfere in troubled banks to lessen disturbances. Regulations are generally developed to restrict banks' direct exposures to credit, market, and liquidity dangers as well as to general solvency threat (see "Protecting the Whole" in this issue of F&D). Financial institutions are now needed to hold even more and also higher-quality equityfor example, in the type of maintained revenues and also paid-in capitalto barrier losses than they were prior to the economic crisis.

Bank Certificate Can Be Fun For Anyone

A bank is a financial establishment authorized to offer solution alternatives for customers who desire to save, borrow or accrue more money. Banks commonly accept down payments from, and offer fundings to, their clients. Can aid you obtain funds without a financial institution checking account.While financial institutions might supply similar financial solutions as credit history unions, banks are for-profit businesses that route many of their financial returns to their shareholders. That implies that they are less most likely to provide you the ideal feasible terms on a finance or a cost savings account.

Those borrowers after that pay the financing back to the financial institution, with interest, over a set time (bank code). As the customers pay off their financings, the financial institution pays a fraction of the paid interest to its account owners for enabling it to make use of the transferred money for provided car loans. To further your individual as well as business interests, financial institutions offer a huge range of monetary services, each with its very own positives and also negatives depending on what your money inspirations are and also just how they might advance.

An Unbiased View of Bank Draft Meaning

Banks are not one-size-fits-all operations. Various kinds of customers will locate that some financial institutions are better financial companions for their goals and requirements than others.The Federal Reserve regulates other financial institutions based in the united state, although it is not the only government firm that does so. Neighborhood banks have go to my blog less possessions because they are inapplicable to a major national financial institution, but they offer economic services throughout a smaller sized geographical footprint, like a region or area.

On-line banks do not have physical areas yet tend to give much better rate of interest on lendings or accounts than financial institutions with physical places. Transactions with these online-only institutions usually happen over a web site or mobile application and therefore are best for someone who does not call for in-person support and also is comfortable with doing many of their banking digitally.

The 9-Minute Rule for Bank Draft Meaning

Unless you prepare to stash your cash money under your cushion, you will eventually require to connect with a financial establishment that can secure your money or issue you a funding. While a bank may not be the establishment you ultimately choose for your financial demands, understanding exactly how they operate and the solutions they can offer can help you determine what to look for when making your choice.Larger financial institutions will likely have a bunch of brick-and-mortar branches and ATMs in convenient areas, in addition to various electronic banking offerings. What's the distinction between a financial institution as well as a credit report union? Because financial institutions are for-profit organizations, they tend to use less appealing terms for their customers than a lending institution may provide to make the most of returns for their capitalists.

a lengthy raised mass, esp of earth; mound; ridgea slope, since a hillthe sloping side of any kind of hollow in the ground, esp when bordering a riverthe left bank of a river is on a spectator's left looking downstream a raised area, rising to near the surface, of the bed of a sea, lake, or river (in mix) sandbank; mudbank the location around the mouth of the shaft of a mine the face of a body of orethe side disposition of an aircraft regarding its longitudinal axis throughout a turn, Also called: banking, camber, cant, superelevation a bend on a roadway or on a train, sports, cycling, or various other track having the outside built higher than the inside in order to decrease the impacts of this content centrifugal force on automobiles, joggers, and so on, rounding it at rate as well as in many cases to promote drainagethe padding of a billiard table. bank draft meaning.

See This Report on Bank Draft Meaning

You'll need to supply a bank statement when you use for a finance, file tax obligations, or documents for divorce. A bank emoji financial institution declaration is a file that summarizes your account task over a certain period of time.

Report this wiki page